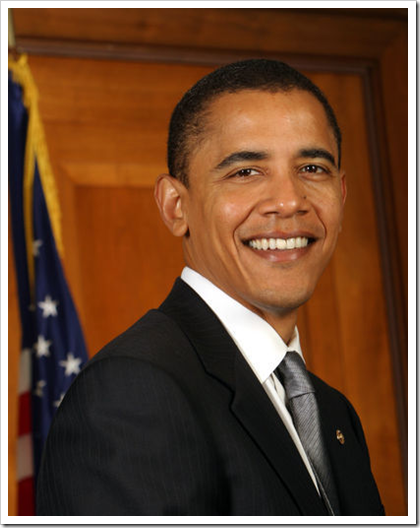

Obama will ‘forgive’ student loans

College debt may be wiped cleans after Obama inacts National Service Bill

President-elect Barack Obama may be expanding Martin Luther King Day from its current national day of community service to an ongoing commitment for all Americans to serve.

Obama’s inaugural committee plans to launch a Web site to link volunteers with service projects in under serviced neighborhoods. The Web site will incorporate existing organizations such as the Corporation for National and Community Services and AmeriCorps.

The exciting part for many former, future, and current college students is that Obama is expected to announce a loan forgiveness program. An Obama supporter described the program as “a way for college students to give back and get out of debt. You’ll be able to volunteer and get credit for up to $10,000 worth of loans per year”.

Mean while, Michelle Obama and daughters Malia and Sasha flew to Washington on Saturday, while President-elect Barack Obama was due to arrive yesterday to settle into the city they will call home for at least the next four years.

Related posts:

Obama’s addicted to sex…

Obama’s $3000 cell phone… ‘Barack-Berry’

Will Smith already made deal to play Obama?

Big Boi is still Outkasted

Big Boi is still Outkasted

Jamie Holts's comment says

Jamie Holts's comment says

On January 5, 2009 at 10:47 pmI’ve been reading along for a while now. I just wanted to drop you a comment to say keep up the good work.

» Obama will ‘forgive’ student loans | Celebrity Gossip, Hip Hop … » Student Loan Rates Online's pingback says

On January 5, 2009 at 11:26 pm[...] news by unknown « Using Guaranteed Student Loans To Pay For College « [...]

2thick4u's comment says

2thick4u's comment says

On January 6, 2009 at 6:34 amThis is great!!!

I hope that he can implement this plan!!!

Boss Hogg's comment says

Boss Hogg's comment says

On January 6, 2009 at 6:46 amNow that’s what I’m talking about. It’s about time the government is thinking about helping the people that want to be helped. I get so tired of seeing the government help the people that sit on their lazy asses and do nothing with their life. They would rather sit home and do nothing all day and collect food stamps and other assistance from the state or federal government. I’m sure I’m not the only college graduate that gets mad when they go to the local grocery store on the third of the month and see people with two and three carts filled up to the rim with groceries and you walk around with the little damn plastic hand carrier. I hope that this happens so my family and me could go and get at least 2 carts filled to the rim. LOL

JaWar's comment says

JaWar's comment says

On January 6, 2009 at 10:07 amOk, now this is one that sounds great thus far. I give my time to in-service community service and some of my student loan debt is forgiving where do I sign up?

“THINK, PLAN, EXECUTE!” -JaWar

atlmuzikfanzinc's comment says

atlmuzikfanzinc's comment says

On January 6, 2009 at 11:09 amNow that’s what’s up, I’m down with that.

TikiaNyuni's comment says

TikiaNyuni's comment says

On January 6, 2009 at 1:35 pmWhen and where can I signup . I am so deep in student loans i cant find the surface to breathe.

The One's comment says

The One's comment says

On January 7, 2009 at 9:34 amI hope so… Lord knows I need this! Please keep me updated on this. If he passes this act or bill then I want to be the first one in line.

Brandon's comment says

Brandon's comment says

On January 20, 2009 at 5:43 pmI accumulated more than $70,000 in student loans, and even though I work two jobs, I’m not making nearly enough to take care of student loans. I understand it’s my own fault, but I feel like I’m being penalized for actually getting an education, which you usually need to obtain a decent job. Instead of giving all these already rich and crooked CEO’s so much money, how about bailing out those struggling to make ends meet? Oh yeah, that makes too much sense…

Thanks so much for this article!

helpmeplease's comment says

helpmeplease's comment says

On January 22, 2009 at 8:06 pmI’m in debt 150,000 and make less than 40,000 a year…this would help me so much. I could maybe buy a house…or start a family….or buy food…or start a retirement fund. Simple things I cannot do because I chose to get an education.

Granny's comment says

Granny's comment says

On January 25, 2009 at 3:13 pmi am the grandmother of three children that graduated from college in May. they are all brothers and a sister. the two boys (twins) graduated in aerospace and aeronautical engineering and computer engineering, the girl in international business. one of the boys had his job secured the middle of march and the other shortly thereafter. the girl did her internship in the summer to complete her degree and was hired by that same company. we feel very fortunate that they all were able to get their education but with quite a bit of debt and now is payup time. it is very hard for them having to pay rent and what goes with it, college loan payment and they all need cars as theirs are very old. i had read that due to the lack of sufficient engineers that they may be able to get some loan forgiveness. the girl with her foreign language being spanish, since she uses her spanish with the company she works with, perhaps would she qualify for some loan forgiveness? i am not asking for full forgiveness but anything would be a big help. they each have about $20,000.00 to pay back. will there be any help for them? thanks!

Bob's comment says

Bob's comment says

On February 13, 2009 at 2:27 pmThat is nice, but instead of just focusing on how to work off the debt, he needs to also focus on how to just flat out eliminate the debt. Currently, student loans are NOT dischargeable in bankruptcy. Yet, credit cards etc are dischargeable. For those who want to perform community service and are in a position to do so this program is fine. However, for those of us forced to file chapter 7 bankruptcy we should be allowed to reopen out case and include ALL student loans. People like myself already have bad credit. I owe nearly 170,000 (principle balance) spread over 30 years = 333,000 in student loans. How long would I have to be a slave laborer to the government to pay off these loans?

To me, this is just a way for the government to create indentured servants to them. The solution is to just forgive them outright and then allow people to take that money and buy a house, buy a car, save for retirement and make whatever contribution to society they feel like making without the government forcing people into working it off in a government sponsored program for 10, 20 30 years.

Such programs work well if someone has only a modest debt. Say 15,000. They work a couple years, make a contribution to society and all is well. It does not work so well for those of us who returned to school at an older age, filed bankruptcy, have no savings etc.

The option to discharge student loans entirely in bankruptcy MUST be restored.

Annie's comment says

Annie's comment says

On February 23, 2009 at 10:23 pmI graduated from college with a Bachelor’s in Social Work. I worked for a couple of years and decided to go back to school for elementary education which is a better paying job. It took me years to get a job in the profession and all the while I was working secretarial positions basically at poverty level per year, I couldn’t afford to pay back my loans. Now I can’t even get a small loan from the bank to buy a car because of my credit from the student loans. We definetly need a bailout and I am sick and tired of stressing over this. How am I ever going to be able to buy a house in the future. My loans are at about $65,000 over a period of 30 years- I will be paying back well over that figure. It’s sickening!

Cherie Colston's comment says

Cherie Colston's comment says

On March 9, 2009 at 8:02 pmI went back to college late in life, and got my Masters in Health Informatics in 2001, right before 9/11, so the job I had counted on went away with the investors in the new company with which I had been assured of a job(the company didn’t happen when the investors pulled out). I got a job with a local university, but it was grant-dependent and the grant ended in three years, leaving me unemployed again.

My student loan is for over $140,000 and I am now 60 years old. The Masters did me no good in getting a another job — as a matter of fact, I am currently unemployed and have health problems to boot. If Obama’s plan went into effect, I would have to work 14 years plus 6 or more extra (to cover interest) and would be 80 years old.

How about either forgiveness or bankruptcy coverage for people like me? I just lost my father to Alzheimer’s and am caring for my 82-year-old mom with the same affliction. How long until I am in the same situation, with no way out of debt, trying to get by on Medicaid?

helpisontheway?'s comment says

helpisontheway?'s comment says

On March 12, 2009 at 2:50 pmHelp may be on the way. We all have to ban together and point out to our elected officials that the process is flawed. Rev. Jesse Jackson and Alan Collinge are spearheading the movement to help debt ridden students. Please lets join the fight. I have listed both the video and links to both websites.

Reduce the Rate: Rev. Jesse Jackson Joins Movement Against Crippling Rates on Student Loans

http://www.democracynow.org/2009/3/12/reduce_the_rate_rev_jesse_jackson

http://www.studentloanjustice.org

http://www.reducetherate.org

jeff's comment says

jeff's comment says

On April 17, 2009 at 2:46 pmplease keep me in formed on the lasted update on obamas forgive program on student loans, I NEED HELP

JohnJohn's comment says

JohnJohn's comment says

On April 18, 2009 at 9:31 pmIts JohnJohn,

So many of you have been looking forward to President Obama’s response to loan forgiveness so here is the latest I’ve heard on the subject.

Check out the link below…hopefully it helps some of you.

http://money.cnn.com/2009/04/15/news/economy/loan_forgiveness/

Anka's comment says

Anka's comment says

On May 11, 2009 at 1:43 amWell, I applied for a program that was supposed to help you if you have worked in underprivileged communities and was not granted the help. There are conditions, you have to know about the right program to help you and on top of it things expire. Now I am doubtful and I am feeling like I will be working for the rest of my life to pay off my plan. I am not motivated and feeling screwed by the system because as I am paying off, the interest is growing … feeling like a slave.

Screwed

Sam J's comment says

Sam J's comment says

On May 26, 2009 at 3:13 pmHello, my name is Sam Johnson an audio engineering graduate of Tempe Arizonas Conservatory of Recording Arts & Sciences.

I graduated from college back in 2004 as a professional AUDIO ENGINEER and have searched high and low for employment, not only in my area of dicipline, but other careers as well.

To this day, (May of 2009) I am still unemployed, over 40, nearly 50, married with children and out of work.

I have tried everything i know to get a job but to no avail and i have thousands of dollars in Student Loans that i have extended, extended, extended, and dont know how or if i am going to pay them off.

I want to go back to school for a more lucrative career in Computer Science but owe student loans, IS THERE ANY HELP FOR ME?

pamper's comment says

pamper's comment says

On June 2, 2009 at 11:03 amI’m in debt to the tune of $64,000!! When I originally took the loans it was about $15,000. The loans can due and were put into deferrment and now $64,000! WOW To top things off I’m the only one working in the household, my spouse was laid-off. We are currently awaiting a decision on a loan modification for our mortgage, so this would be a life saver!!

murungu's comment says

murungu's comment says

On June 5, 2009 at 4:35 pmI hope this pans out. I also hope the credit rate is better than $6.50 per volunteer hour. Mr Obama has paid out so much money to people who don’t need it, why does he just not pay off the first $50 000 of every college loan.

I also hope there are no strings like “only if you earn less than $X per month. He could also allow spouses to go volunteer and have the time credited to their spouse’s loan.

Here’s hoping.

patti's comment says

patti's comment says

On June 8, 2009 at 10:57 amI graduated with a master’s in counseling, began working then developed Multiple Sclerosis so I couldn’t work much more than part time. I want to continue to work and have no desire to go on disability, but have to be careful about how many hours I work. When I contacted the student loan lender I was shocked to discover while there is loan forgiveness (100%) for the disabled, if you are PARTIALLY disabled there is no accomodation for this. In other words, I have a double burden to carry because I can only work parttime and am viewed the same way someone who can work fulltime. I now owe $90000 in student loans, am 60 yrs old, WANT to work yet there is no provision for my situation. What about folks like me? There have got to be others out there facing similar circumstances. It’s better to go 100% disability and NOT contribute to society than try to work and pay them back…

Michelle's comment says

Michelle's comment says

On June 9, 2009 at 1:32 pmWell, I concur with the ideal because although an education was a great thing to achieve. We all should have taken into consideration the amount we receive as a loan. There are people who need help with little things, as in tutoring, mentoring, and other small things we can do for the loans we received. It would become great to give back to the community if we receive this help. Let’s be considerate of others which would suffer also if we receive this token of appreciation.

Jessica's comment says

Jessica's comment says

On June 16, 2009 at 11:52 amI am in the same boat as many of you. I have over $50K in student loan debt, work several jobs, and still can’t pay the bills. I live with my parents and have two of the three loans on deferrment. I feel like I’m trapped by my education, and I can’t even find a job in my field. So whatever happens with working it off, or forgiveness of some sort, I am hopeful that it helps. And I hope there is no stupid clause of having a certain amount of debt or making under a certain amount.

J Jefferson's comment says

J Jefferson's comment says

On June 18, 2009 at 11:23 amThats sounds great; where do I sign the dotted line…

AmandahinAZ's comment says

AmandahinAZ's comment says

On July 3, 2009 at 12:23 pmThis is a great idea! I like many people would rather sit around and be bailed out like the greedy corporations…BUT doing community service for it is not that bad either…

Even if it’s only around 10,000 a year that would help me SO much I have 115,000 in student loans and I’m an entry level student. I’m assuming this would be VERY limited community service though, because otherwise it wouldnt be forgiveness at all… just a part time second job that pays a dismall 833 a month.

The only thing is we know most of these neighborhoods are black etc. one has to be concerned for their safety when they go to ‘help out’ in these neighborhoods especially if they’re white, no point in doing community service for the money getting shot and not being able to pay the loan anyway. All you do is end up racking up funeral expenses as well for your family left behind.

Pete's comment says

Pete's comment says

On July 22, 2009 at 2:00 pmSTOP!!! The devil is in the details on this Loan Forgiveness Program…. basically, the gov’t will tell you that 10 years after you graduate, you have to work where they will tell you to work… and it will be in the gov’t service sector… where you won’t make much money… so forget about raising a family or buying a house in those 10 years… you will lose 10 years of xperience building in the private sector, where you could really provide for your family…. careful what you wish for

Pete's comment says

Pete's comment says

On July 22, 2009 at 2:07 pmDevil in the details to this loan forgivness program… The forgiveness occurs after 120 monthly payments made on or after October 1, 2007 on an eligible Federal Direct Loan. Periods of deferment and forbearance are not counted toward the 120 payments. Payments made before October 1, 2007 do not count. Likewise, only payments on a Federal Direct Loan are counted. So if you have a loan prior to 2007… your not covered

Pete's comment says

Pete's comment says

On July 22, 2009 at 2:09 pmDevil in the detail…. here is where they tell you where you have to work FULL TIME Employment: The borrower must be employed full-time in a public service job for each of the 120 monthly payments. Public service jobs include, among other positions, emergency management, government (excluding time served as a member of Congress), military service, public safety and law enforcement (police and fire), public health (including nurses, nurse practitioners, nurses in a clinical setting, and full-time professionals engaged in health care practitioner occupations and health care support occupations), public education, early childhood education (including licensed or regulated childcare, Head Start, and State-funded prekindergarten), social work in a public child or family service agency, public services for individuals with disabilities or the elderly, public interest legal services (including prosecutors, public defenders and legal advocacy on behalf of low-income communities at a nonprofit organization), public librarians, school librarians and other school-based services, and employees of tax exempt 501(c)(3) organizations. Full-time faculty at tribal colleges and universities, as well as faculty teaching in high-need subject areas and shortage areas (including nurse faculty, foreign language faculty, and part-time faculty at community colleges), also qualify

Pete's comment says

Pete's comment says

On July 22, 2009 at 2:13 pmDevil in the details… today a student can get a Federal Family Education Loans, or FFEL. These types of loans are typically offered by private banks and lenders…. these loan come with NO STRINGS ATTACHED…. If President Obama gets his way, these FFEL loans with no longer exist, leaving the only Federal Loan program is the one KI mention above… you the student will have no choice…. this is a sly way of more gov’t taking more control of your lives

Pete's comment says

Pete's comment says

On July 22, 2009 at 2:21 pmMore details – The public service loan forgiveness program that will begin in 2009 makes good headlines, Diane Auer Jones, assistant secretary for postsecondary education, told attendees of a Washington, D.C., College Savings Foundation conference this month. But many idealistic students hoping to get out from under their federal education debts will be sorely disappointed, she says.

“Guess what? You have to make 10 years of payments,” before the remainder of the loan is forgiven, she notes. And most federal education loans are 10-year loans, which means there will be nothing left to be forgiven.

The Education Department is worried “some students will see the program and take on more debt than they would have otherwise, not realizing it is unlikely that most of it will be forgiven,” she says.

Pete's comment says

Pete's comment says

On July 22, 2009 at 2:22 pmmore detials — In addition, the new “Teach grants” that this year started paying up to $4,000 a year to those studying to be teachers in needy schools will turn into costly mistakes for the vast majority of recipients, she says. Teachers who do not end up working in classrooms that qualify as “high need” will see those grants they received while in school turn into loans. Jones says the Education Department’s experience with other similar programs indicates 80 percent of the recipients of Teach grants will have to pay them back with interest. The problem, she says, is that newly graduated teachers are having trouble getting hired by what she called “dysfunctional” but needy schools.

Robert Shireman, director of the Project on Student Debt, says that people should realize the new public service forgiveness program will help only those who take low-paying public service jobs. Borrowers who take on high-paying government or nonprofit jobs will have to pay off their loans, he said.

jt's comment says

jt's comment says

On August 19, 2009 at 6:54 pmI agree with you all

Mz. Thang's comment says

Mz. Thang's comment says

On August 29, 2009 at 4:34 pmNigga make it happen!!!

Len's comment says

Len's comment says

On January 19, 2010 at 8:48 pmI really really pray that he pushes this through. Corporate America is raping America’s youth. We are in large amounts of debt long b4 we ever get a chance to get a piece of the so called American Dream. PPL wonder why the economy is so bad. College costs and loans put many ppl in the hole for thousands of dollars right out the gate. They have too much power to ruin credit and thus many ppl’s lives. Something must be done. If Obama does fix this problem then he’s a sure fire win for a second term. The youth of American would back him 120%

Ryan's comment says

Ryan's comment says

On January 27, 2010 at 7:30 pmThis is crap. I was 60K in debt when I graduated college and I worked my a@@ off to get it paid off. Now I have to pay higher taxes to pay for this crap. I am soooo sick of these politicians spending. Some advice to those who have high student loans. Work your a@@ off and save and pay them off. The American way is to work hard, not to have a government hand out.

Up by my bootstraps's comment says

Up by my bootstraps's comment says

On April 3, 2010 at 6:59 amI was $25,000 in debt to SallieMae when I graduated college some years ago. The student loan program is very generous and forgiving. When I had times where I wasn’t earning much, I was able to postpone payments; when I decided to go back for a Master’s degree, they put my payments on hold. Eventually it took me a total of 10 years to pay it off, but I did. I didn’t look to others or the government to help me out. These whining college students today need to just tough it out (maybe really they don’t need the latest Blackberry or the hottest car) and pay up. It’s not a free ride – it’s called meeting your responsibilities – also known as being an ADULT. Grow up, you weenies! Stop expecting a handout from those of us who are responsible.

chuck's comment says

chuck's comment says

On April 17, 2010 at 8:59 pmdo you all know that to have $10k forgiven by Mr. Obama you will have to join his civil army that he is implementing.do your homework people nothing is free ever.they use the work volenteer ,organizer ect but in the end it’s control of you what you do how you do it for who you do it and you will never advance to anything beyond what the goverment dictates to you that is not right read the truth this is very dangerous.it’s not what it sounds like.educate yourselves on this issue before you jump into the fire.

Starspire's comment says

Starspire's comment says

On May 19, 2010 at 8:28 pmCool avitar…